CPS Energy’s offices and customer service centers will be closed on Wednesday, December 31, 2025 and Thursday, January 1, 2026, in observance of New Year's Day. We will reopen on Friday, January 2, at 7:45 AM. Although our call center will be closed for regular business, we remain open for customers to report natural gas or electric emergencies at any time by calling 210-353-HELP (4357) or 1-800-870-1006. Online services may be conveniently accessed through Manage My Account (MMA).

Employee Benefits - Pension Plan & 457 Plan

Links to Employee Benefits

Other Helpful Links

CPS Energy provides two retirement benefits. A Defined Benefit Pension Plan and a voluntary 457 Deferred Compensation Plan.

Pension Plan:

The CPS Energy Pension Plan provides a monthly retirement benefit that is determined by a formula that considers age, years of service, average monthly compensation, and a Social Security offset.

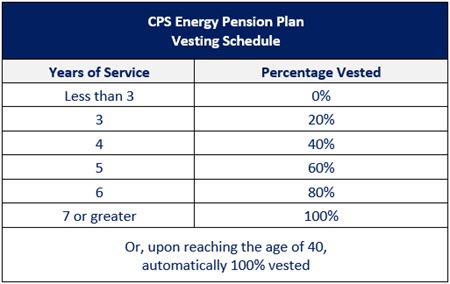

All full-time employees, who are at least age 21, contribute 5% of their pay after completing one full year of employment. Employer contributions are based on the pension vesting schedule below.

Employees qualify for retirement benefits when they have 25 years of benefit service, are age 55 with 10 years of benefit service or are age 65, which is considered normal retirement age.

An employee who leaves CPS Energy before becoming eligible for retirement is entitled to 100% of his/her contributions plus accumulated interest on those contributions. The employee may also be eligible for matching employer contributions, depending on the vesting schedule.

457 Plan:

The 457 Plan is a voluntary savings plan that supplements retirement savings. This plan is similar to a 401(k) plan but is only offered through governmental entities. Contributions are made with pre-tax dollars to reduce taxable income. There are no employer contributions to this plan. Investments grow tax-deferred. Employees may enroll at any time.